Looking for Free Tax assistance?

Never fear, VITA is here with options for you!

The Volunteer Income Tax Assistance program exists to empower college students and community members with tax knowledge. We have options for self-filing with support, workshops to learn about the free-filing options, and tax preparation services by IRS-certified volunteers. Our goal is to improve tax literacy and financial wellbeing with the community.

Tax Assistance Options*

January through April, we provide three options for your basic tax preparation. Choose what's best for you.

Self-Filing

Get started filing taxes on your own. Your adjusted gross income (AGI) cannot exceed $84,000 to be eligible for this option. Tax support is provided.

Tax Workshop

Sign up for online group tax workshop to learn more about the basics of E-filing tax returns for free.

We Do It

IRS-certified volunteers will prepare tax return for you. Your adjusted gross income (AGI) cannot exceed $67,000 to be eligible for this option. Start the process by scheduling an appointment.

*VITA sites offer free tax assistance to low-to-moderate income taxpayers, taxpayers with disabilities, and limited English-speaking taxpayers.

For Taxpayers*

We want to do everything we can to help you. In order to do that, we need you to understand what tax returns we can help with and what documents you need to have available when you meet with us.

For Volunteers

The more volunteers we have, the more people we can help. Becoming an IRS-certified volunteer takes about a month, and no prior tax experience is needed. Find out what you need to do to become certified.

international student Tax Assistance

Filing taxes for international students is very different from regular income tax filing for United States tax residents. VITA volunteers with foreign student certification can assist international students with both federal and state E-filing.

Year-round Resources

Check out the services provided by our Center for Financial Wellness.

Tax preparation is a good first step to financial wellness, but there is more to your finances, including spending plans, establishing credit and positive saving practices. Our Center for Financial Wellness is here to help!

Meet a

Phoenix

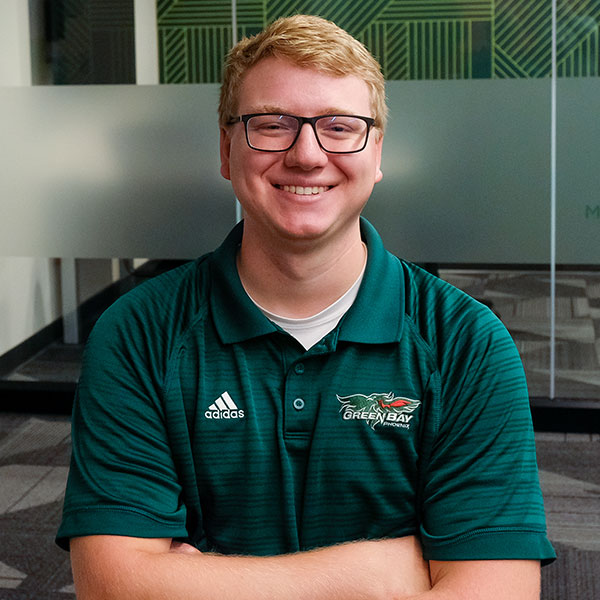

"[VITA] is great hands-on learning for the Accounting students because they're able to do tax returns and get them reviewed by a professional, and they're able to learn from that."

Owen Simonar '24

Staff Accountant at Uphill CPA Firm

Need Support?

Meet Professor Zhuoli Axelton, the director of this program. If you want to make an appointment, have questions about becoming certified or need more information, don't hesitate to get in touch with her!